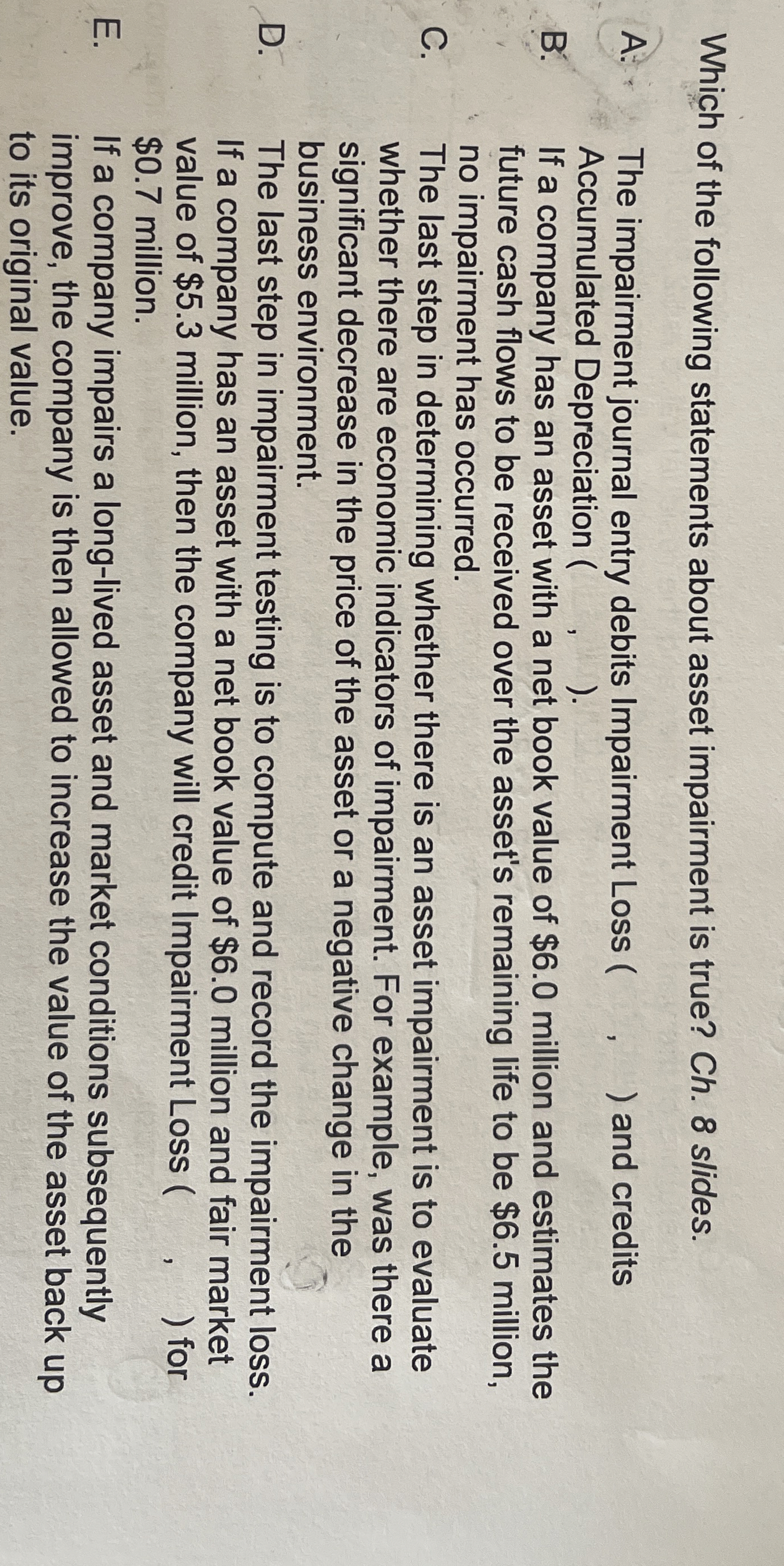

(Solved): Which of the following statements about asset impairment is true? Ch. 8 slides. A. : The impairment ...

Which of the following statements about asset impairment is true? Ch. 8 slides. A. : The impairment journal entry debits Impairment Loss ( , ) and credits Accumulated Depreciation ( , ). B. If a company has an asset with a net book value of

$6.0million and estimates the future cash flows to be received over the asset's remaining life to be

$6.5million, no impairment has occurred. C. The last step in determining whether there is an asset impairment is to evaluate whether there are economic indicators of impairment. For example, was there a significant decrease in the price of the asset or a negative change in the business environment. D. The last step in impairment testing is to compute and record the impairment loss. If a company has an asset with a net book value of

$6.0million and fair market value of

$5.3million, then the company will credit Impairment Loss ( , ) for

$0.7million. E. If a company impairs a long-lived asset and market conditions subsequently improve, the company is then allowed to increase the value of the asset back up to its original value.