Home /

Expert Answers /

Finance /

which-of-the-following-is-true-of-systematic-risk-it-is-affected-by-the-level-of-diversification-wi-pa711

(Solved): Which of the following is true of systematic risk? It is affected by the level of diversification wi ...

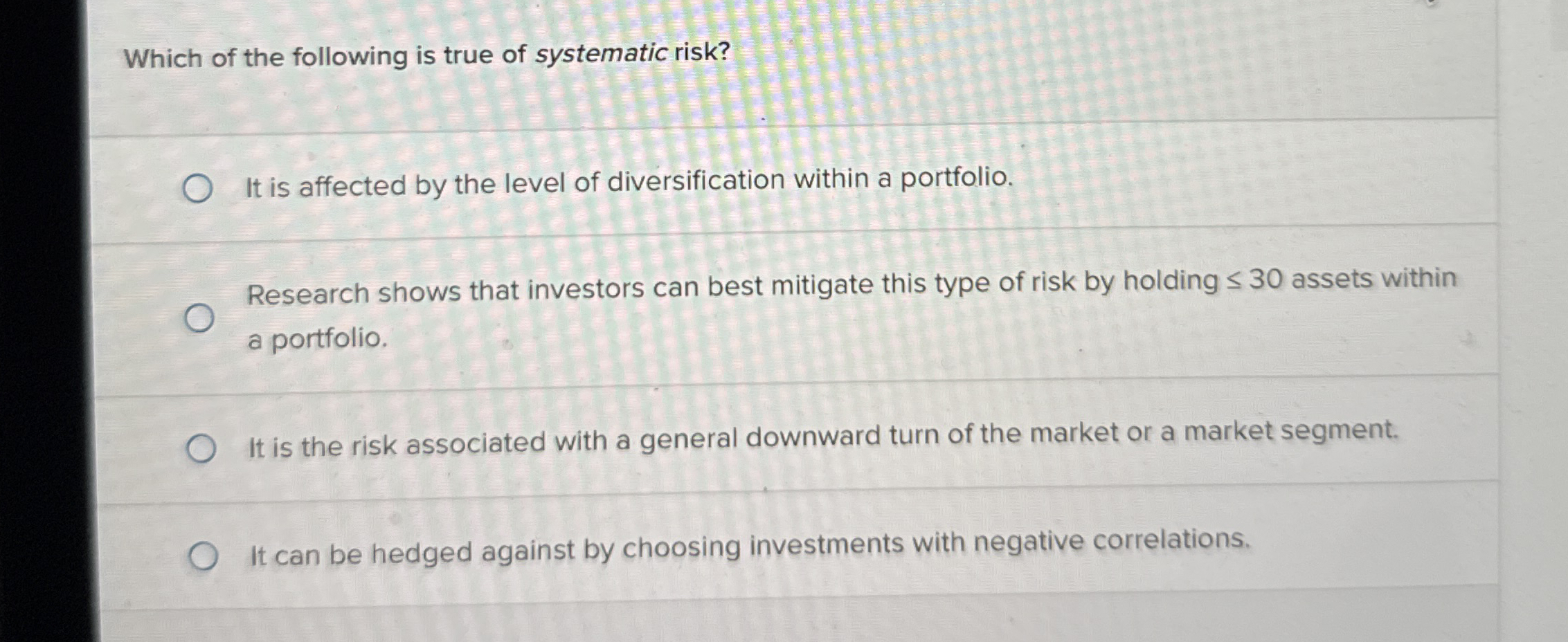

Which of the following is true of systematic risk? It is affected by the level of diversification within a portfolio. Research shows that investors can best mitigate this type of risk by holding

<=30assets within a portfolio. It is the risk associated with a general downward turn of the market or a market segment. It can be hedged against by choosing investments with negative correlations.