Home /

Expert Answers /

Finance /

question-15-a-stock-is-selling-in-the-market-at-100-00-per-share-the-firm-is-going-to-pay-the-ne-pa930

(Solved): QUESTION 15 A stock is selling in the market at $100.00 per share. The firm is going to pay the ne ...

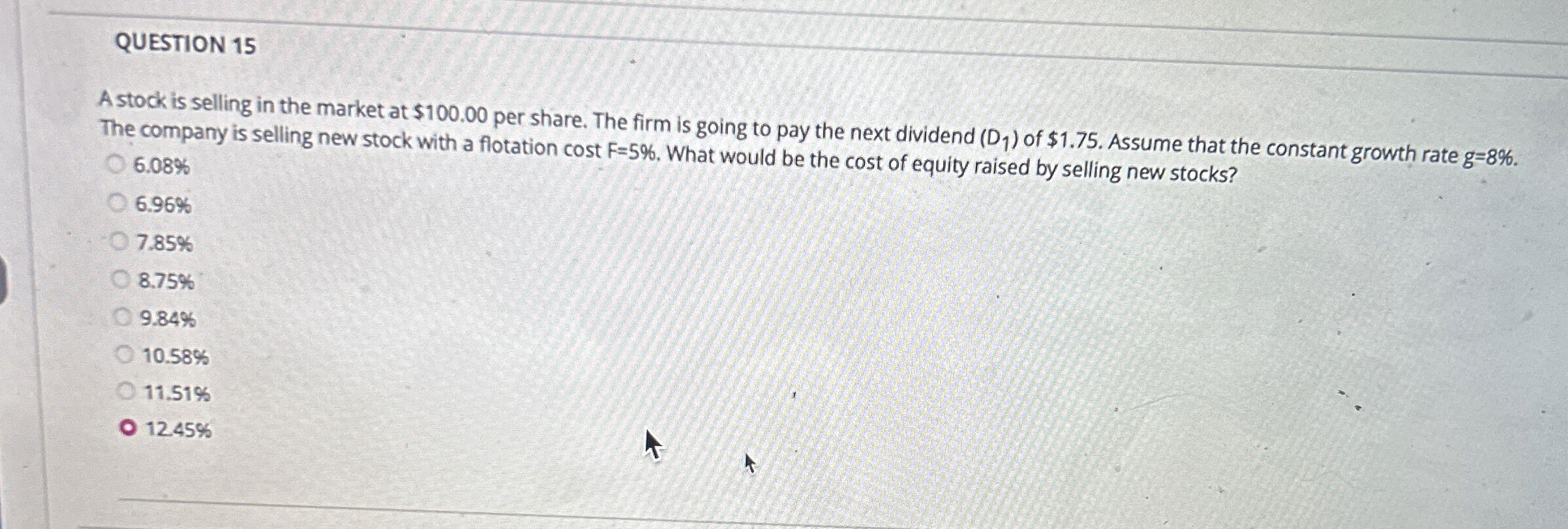

QUESTION 15 A stock is selling in the market at

$100.00per share. The firm is going to pay the next dividend

(D_(1))of

$1.75. Assume that the constant growth rate

g=8%. The company is selling new stock with a flotation cost

F=5%. What would be the cost of equity raised by selling new stocks? 6.08% 6.96% 7.85% 8.75% 9.84% 10.58% 11.51% 1245%