(Solved): Problem 8-6 (Algorithmic) Modified Accelerated Cost Recovery System (MACRS) and Bonus Depreciation ( ...

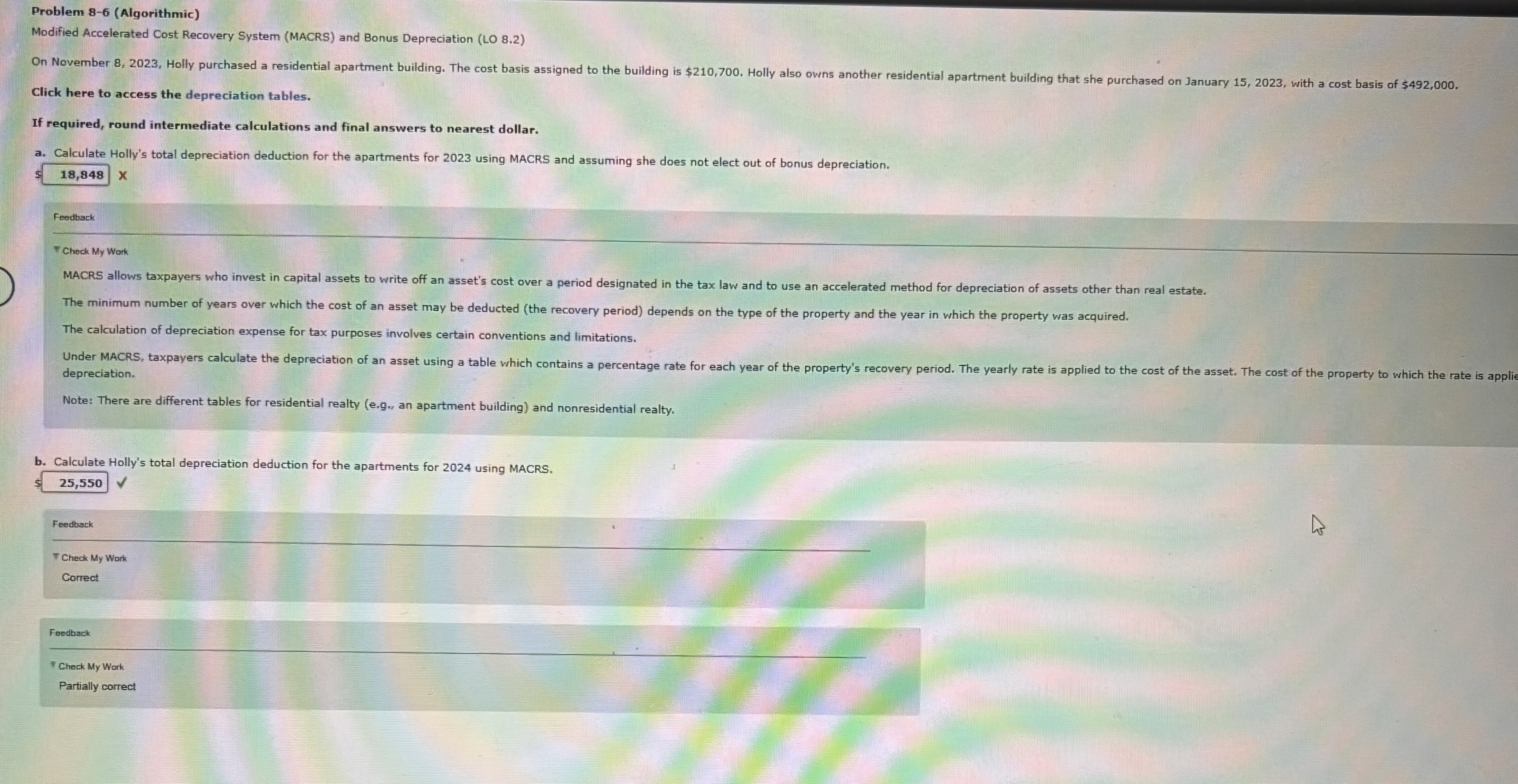

Problem 8-6 (Algorithmic) Modified Accelerated Cost Recovery System (MACRS) and Bonus Depreciation (LO 8.2) Click here to access the depreciation tables. If required, round intermediate calculations and final answers to nearest dollar. a. Calculate Holly's total depreciation deduction for the apartments for 2023 using MACRS and assuming she does not elect out of bonus depreciation.

518,848xFeedtusck T Check My Work The calculation of depreciation expense for tax purposes involves certain conventions and limitations. depreciation. Note: There are different tables for residential realty (e.g* an apartment building) and nonresidential realty. b. Calculate Holly's total depreciation deduction for the apartments for 2024 using MACRS.

◻Feedback T Cheok My Work Correct Feedbreck Check My Work Partially correct