(Solved): Please help . Where am i going wrong ? Parento Inc. owns 80\% of Santana Corp. The consolidated fi ...

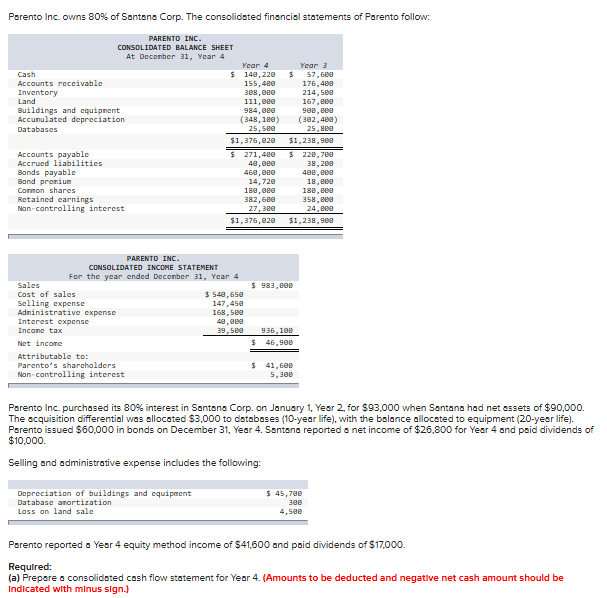

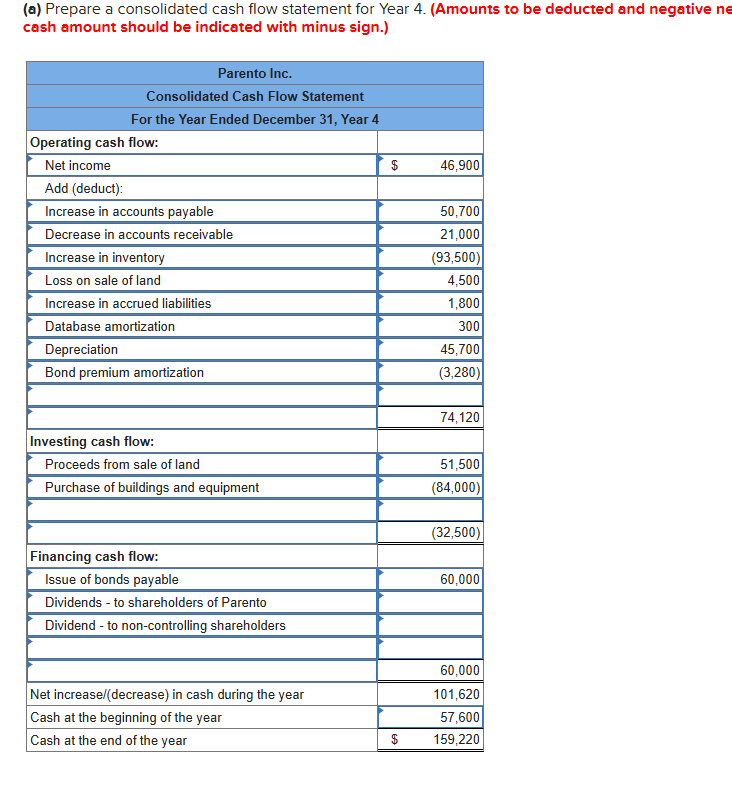

Please help . Where am i going wrong ? Parento Inc. owns 80\% of Santana Corp. The consolidated financial statements of Parento follow: Parento Inc. purchased its \( 80 \% \) interest in Santana Corp. on January 1, Year 2, for \$93,000 when Santana had net assets of \( \$ 90,000 \). The acquisition differential was allocated \( \$ 3,000 \) to databases ( 10 -year life), with the balance allocated to equipment (20-year life). Parento issued \( \$ 60,000 \) in bonds on December 31, Year 4 . Santana reported a net income of \( \$ 26,800 \) for Year 4 and paid dividends of \( \$ 10,000 \). Selling and administrative expense includes the following: Parento reported a Year 4 equity method income of \( \$ 41,600 \) and paid dividends of \( \$ 17,000 \). Required: (a) Prepare a consolidated cash flow statement for Year 4. (Amounts to be deducted and negative net cash amount should be Indicated with minus sign.) (a) Prepare a consolidated cash flow statement for Year 4. (Amounts to be deducted and negative ne cash amount should be indicated with minus sign.)