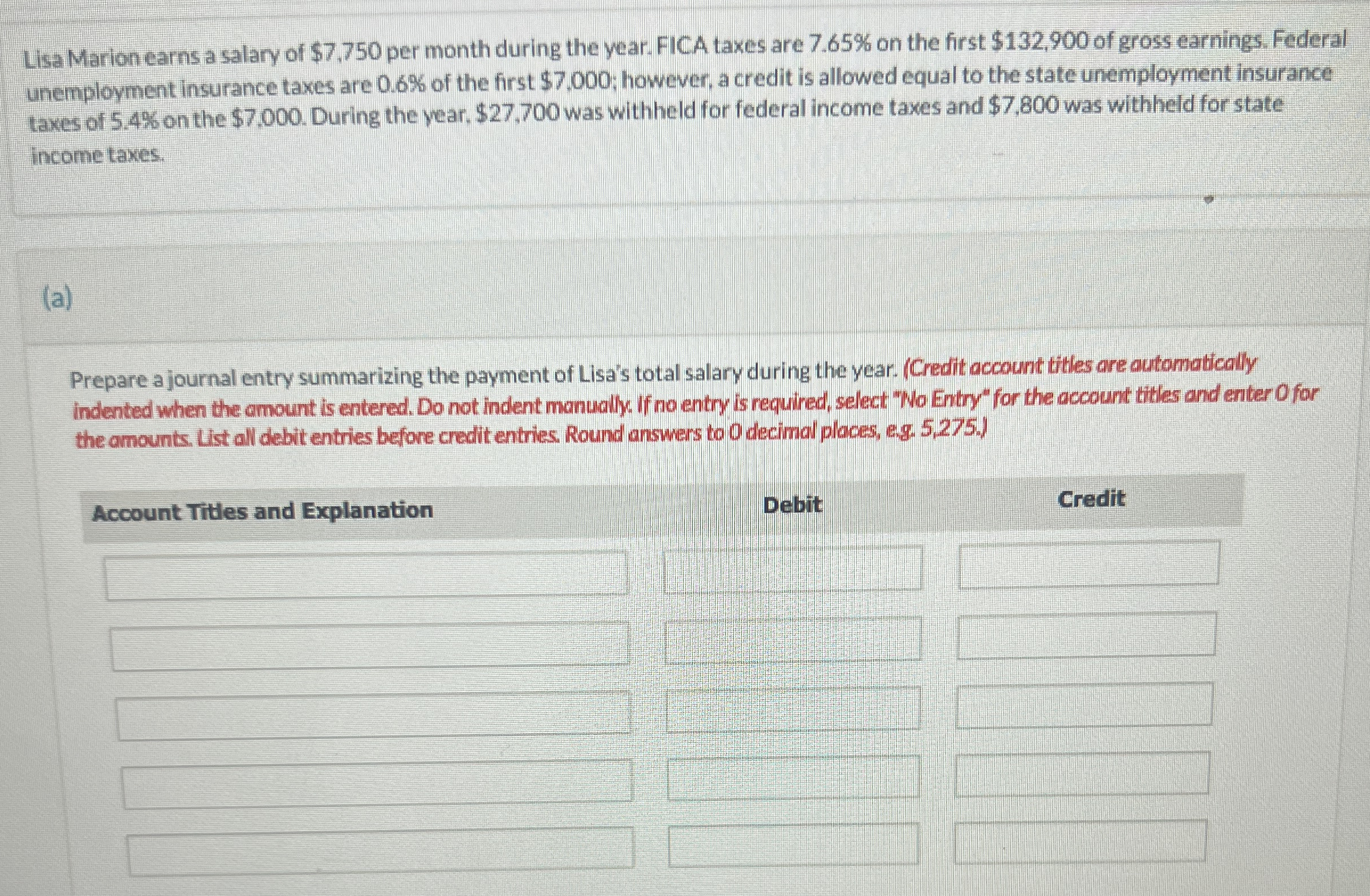

(Solved): Lisa Marion earns a salary of $7.750 per month during the year. FICA taxes are 7.65% on the first $1 ...

Lisa Marion earns a salary of

$7.750per month during the year. FICA taxes are

7.65%on the first

$132,900of gross earnings. Federal unemployment insurance taxes are

0.6%of the first

$7,000; however, a credit is allowed equal to the state unemployment insurance taxes of

5,4%on the

$7,000. During the year,

$27,700was withheld for federal income taxes and

$7,800was withheld for state income taxes. (a) Prepare a journal entry summarizing the payment of Lisa's total salary during the year. (Credit account tittles are autonatically indented when the amount is entered. Do not indent manually. If no entry is required, select. "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Round answers to O decimal places, eg. 5,275., Account Titles and Explanation Debit Credit

◻

◻

◻

◻

◻

◻

◻

◻

◻

◻

◻

◻

◻