Home /

Expert Answers /

Finance /

intro-you-39-ve-done-some-security-analysis-and-generated-the-following-data-for-two-stocks-and-trea-pa378

(Solved): Intro You've done some security analysis and generated the following data for two stocks and Treasur ...

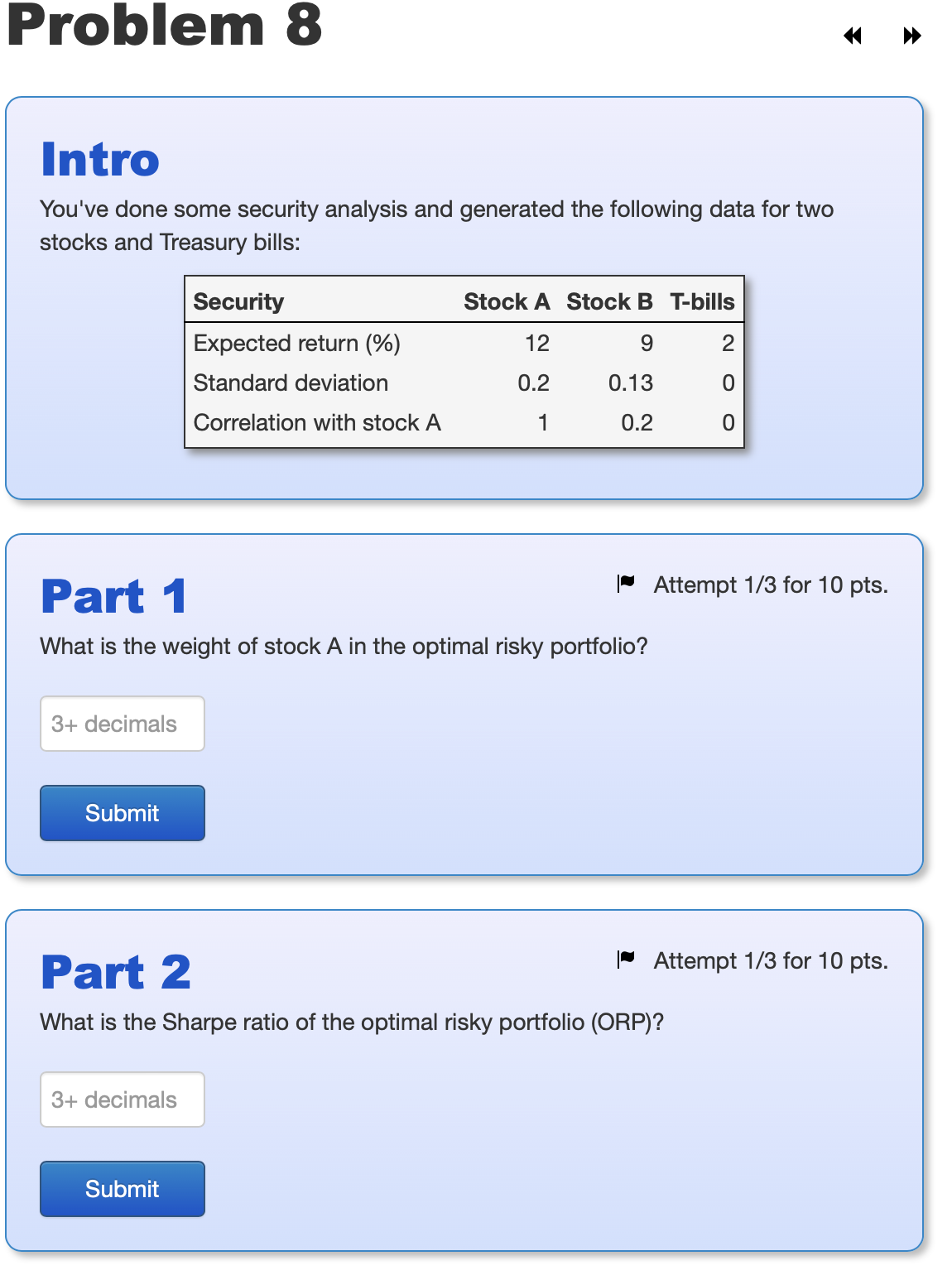

Intro You've done some security analysis and generated the following data for two stocks and Treasury bills: Part 1 Attempt 1/3 for 10 pts. What is the weight of stock A in the optimal risky portfolio? Part 2 Attempt 1/3 for 10 pts. What is the Sharpe ratio of the optimal risky portfolio (ORP)?