Home /

Expert Answers /

Accounting /

c-corporatlons-trade-or-business-property-transactlons-exam-question-6-of-15-select-the-best-answe-pa129

(Solved): C Corporatlons - Trade or Business Property Transactlons Exam Question 6 of 15 Select the best answe ...

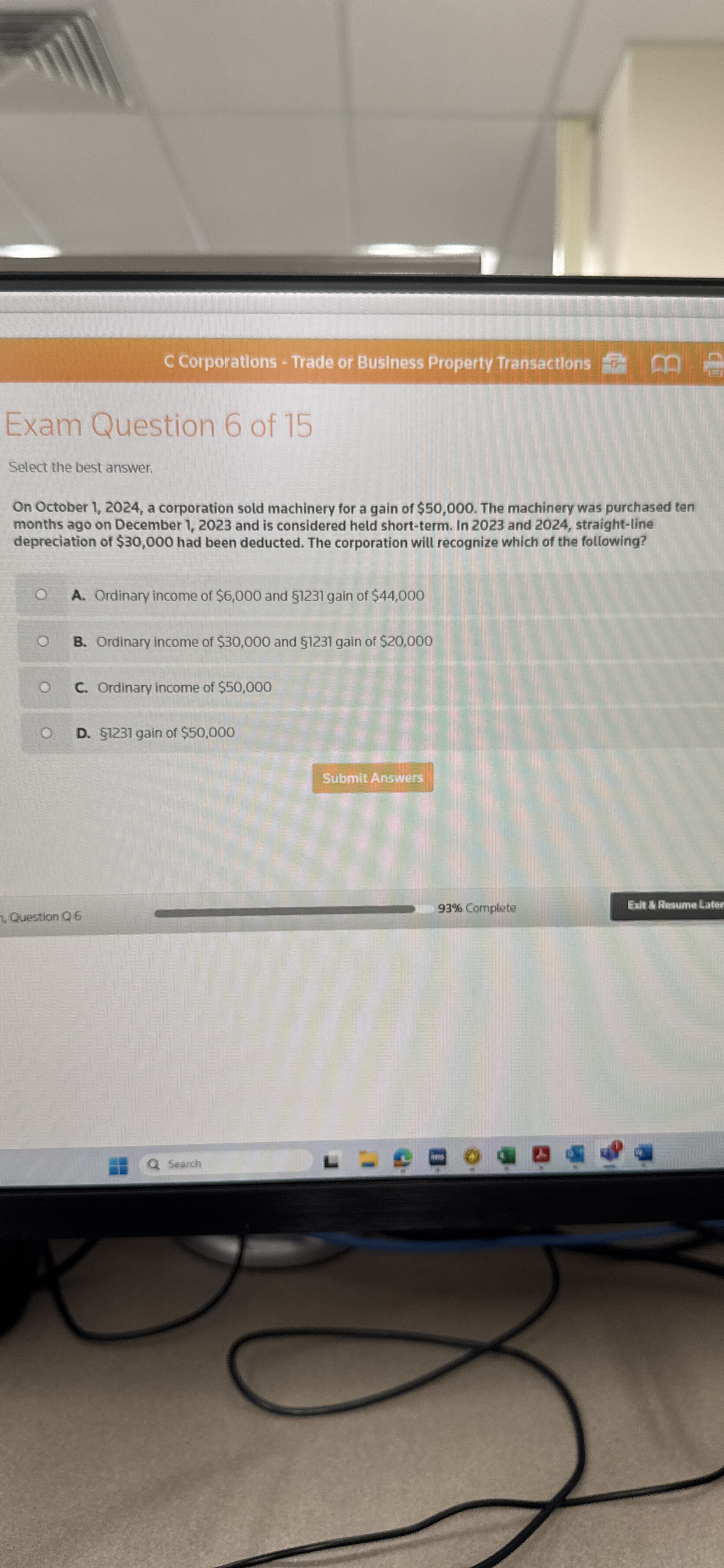

C Corporatlons - Trade or Business Property Transactlons Exam Question 6 of 15 Select the best answer. On October 1, 2024, a corporation sold machinery for a gain of

$50,000. The machinery was purchased ten months ago on December 1, 2023 and is considered held short-term. In 2023 and 2024, straight-line depreciation of

$30,000had been deducted. The corporation will recognize which of the following?

◻A. Ordinary income of

$6,000and

§1231gain of

$44,000B. Ordinary income of

$30,000and

§1231gain of

$20,000C. Ordinary income of

$50,000D.

§1231gain of

$50,0002, Question Q6 93% Complete