Home /

Expert Answers /

Accounting /

an-asset-39-s-book-value-is-19-100-on-december-31-year-5-assuming-the-asset-is-sold-on-december-31-pa789

(Solved): An asset's book value is $19,100 on December 31 , Year 5 . Assuming the asset is sold on December 31 ...

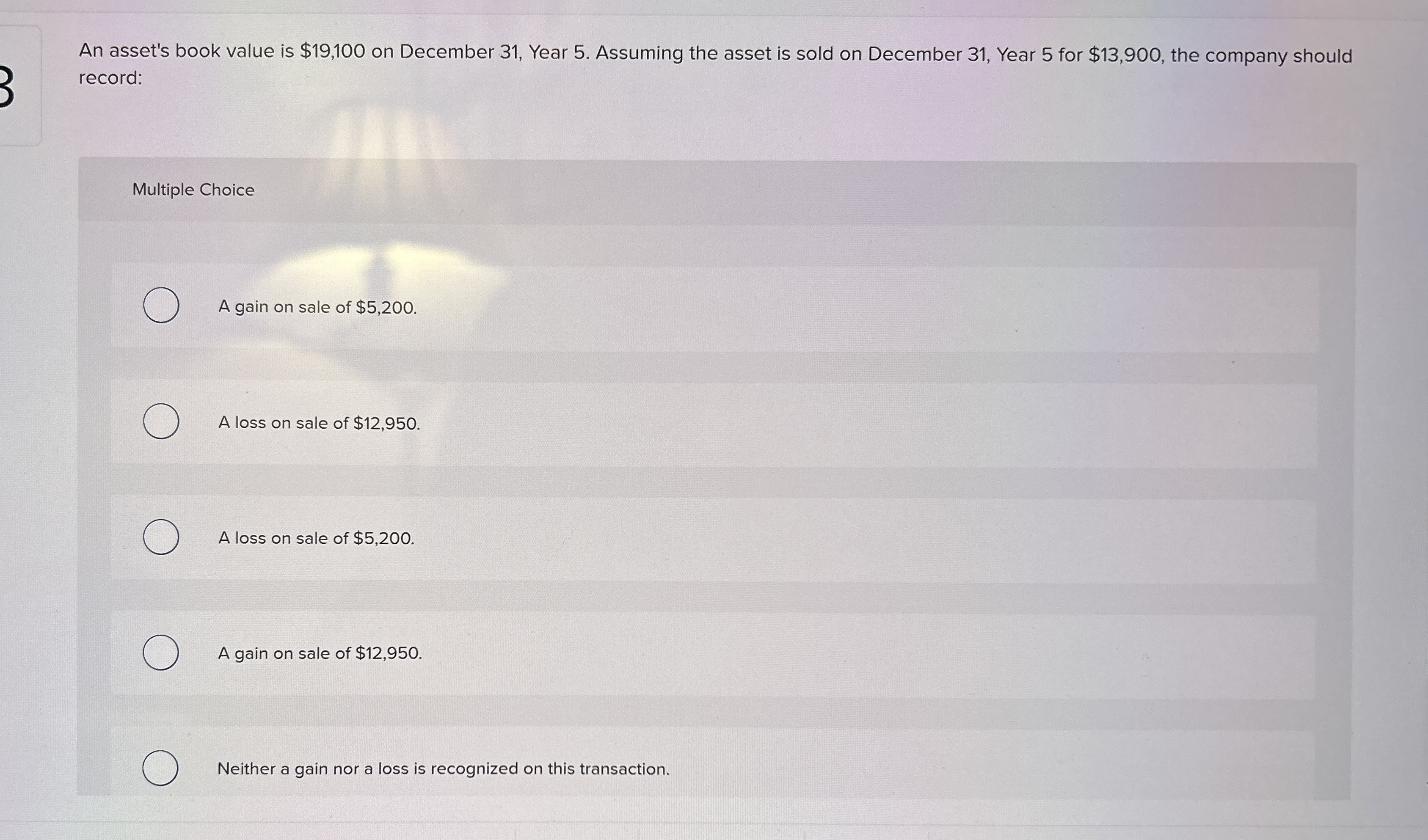

An asset's book value is

$19,100on December 31 , Year 5 . Assuming the asset is sold on December 31 , Year 5 for

$13,900, the company should record: Multiple Choice A gain on sale of

$5,200. A loss on sale of

$12,950. A loss on sale of

$5,200. A gain on sale of

$12,950. Neither a gain nor a loss is recognized on this transaction.